Understanding Your Health Insurance Card

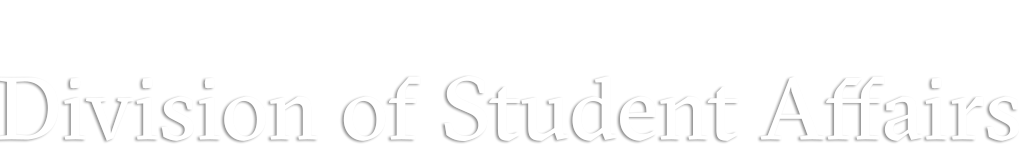

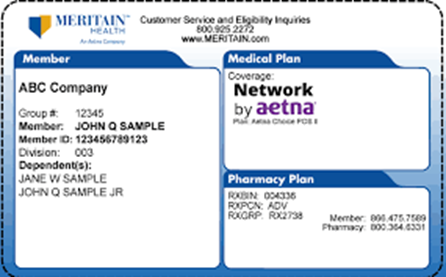

Note that insurance cards can look different. However, your card should contain basic information like:

- Insurance Company Name – Also known as the Insurance Carrier.

- Member name and member number – also called the policy number or identification number. This helps your insurance company identify the primary subscriber and all dependents on the plan. When a doctor’s office submits a healthcare claim for you, they will need both basic demographic information for you, the patient, but also the primary subscriber like their name, gender, date of birth, and current address.

- Group number. The group number identifies what group you are part of in your insurance plan. It helps identify your benefits in that specific plan. Most insurance plans issue group numbers.

- Effective date. This date shows when your insurance coverage begins (or start date). Most insurance cards list this information, though not all do. If you have any concerns about the plan effective dates of your insurance, please call the member services phone number on your card.

- Insurance contact information. Your insurance company contact information is listed on your card. You should call your insurance company if you have questions or need help with: finding an in-network provider, determining your insurance member benefits, or asking how a claim processed.There may be different phone numbers or even different insurance cards for other services like prescriptions/pharmacy, dental, vision, or mental/behavioral health.

Other Important Information

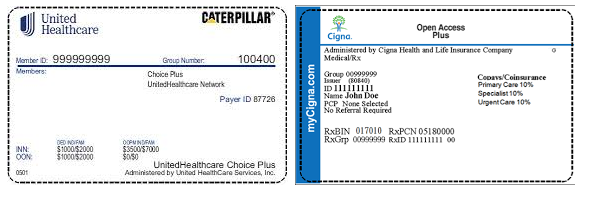

How to Locate the Payer ID or EDI

The Payer ID or EDI is a unique ID assigned to each insurance company. It allows provider and payer systems to talk to one another to verify eligibility, benefits and submit claims.

The payer ID is generally five characters, but it may be longer. It may also be alpha, numeric, or a combination. The payer ID is often located on the back of the insurance card in the Provider or Claims Submission section. Below are some common examples.

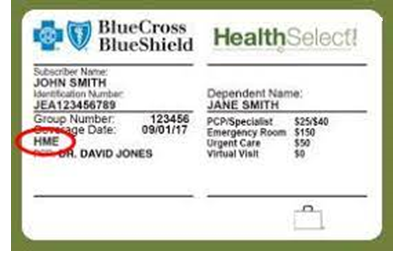

Determining if Your Plan is an HMO, EPO, or PPO

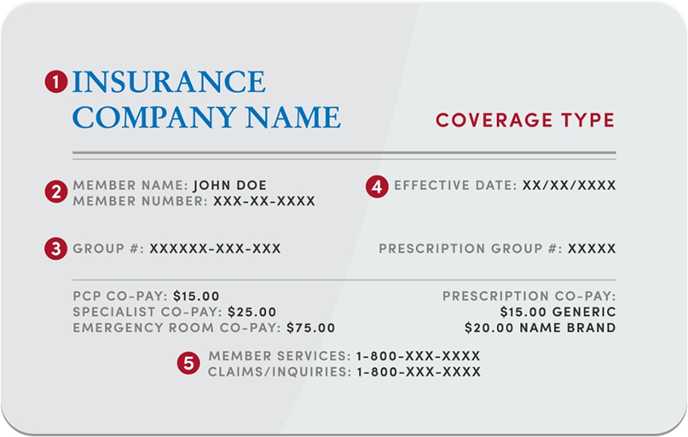

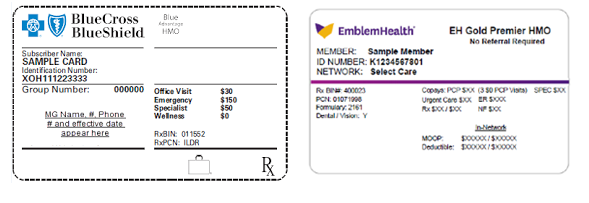

Many insurance cards will list what type of plan you have on the insurance card itself.

HMO Plans

The card will have HMO written on the card, many times notating if the plan requires referrals. Blue Cross Blue Shield uses the symbol of an empty suitcase to indicate HMO plans.

Other plans like Health Select are considered a point-of-service plan, however they function like a HMO.

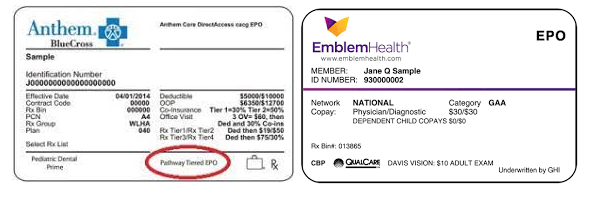

EPO Plans

The card will have EPO written on it and many times list the associated hospital or regional network your plan may be limited to. We recommend confirming your in-network status directly with your insurance carrier.

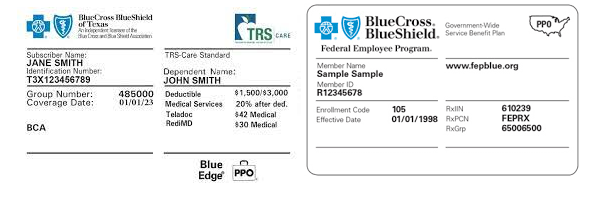

PPO Plans

The card will have PPO written on it. Blue Cross Blue Shield often times utilizes the symbol of a suitcase + PPO.

Other examples

Other insurance cards may include their own label for what your plan is, like “Choice Plus” or “Open Access Plus”. While University Health Services tries to do our best to indicate when those plans are in-network, it is always best to confirm what type of plan you have directly with your heath insurance carrier by calling the member services phone number listed on your insurance card.

Does my insurance plan use a wider wrap around coverage network?

Many insurance cards will indicate if your insurance plan participates in an additional provider network that allows you access to a larger pool of in-network providers. For example, with this insurance card, Meritain Health would be the insurance carrier and who your doctor would submit your claims to, however you have access to the Aetna Choice POS II network of providers.

If you are unable to determine if your insurance is in-network, please contact your health plan for assistance.

Always reach out to your insurance if you need any assistance obtaining or understanding this information OR for help in determining your member benefits. Most health insurances have dedicated customer support teams to help answer these types of questions for their members.